CRISP scored Mangroves (CRISP-M)

Support Mangrove Restoration. Earn Yield.

Drive impact: Make the market for forward financing mangrove restoration projects through CRISP-M.

Low volatility RWAs: You are exposed to the price of mangrove restoration carbon credits.

Competitive incentives: You are rewarded with vAPR in CRISP-M tokens.

No lockup: You can unstake or claim rewards at any time. Your tokens are yours.

6.45% vAPR

0.00%

USDC

6.45%

CRISP-M

*Risks apply. KYC required. Read details here.

Any swap transactions are orchestrated via 0x Protocol and Uniswap. Liquidity is maintained via Gamma Protocol. Solid World is not responsible for the performance of these systems. See Terms of Service for more details.

CRISP-M Price

$0.00

Circulating Supply

$0.00

DEX Trading Volume

$0.00

CRISP-M Liquidity Pool Statistics

Pool Composition

USDC 0.00%

CRISP-M 0.00%

0 USDC

0 CRISP-M

Total Value Staked

$0.00

(0 CRISP-M LP Token)

Trading range

$0.00 – $0.00

CRISP-M is 1-1 backed

Verra Mangrove Restoration prepaid carbon credits

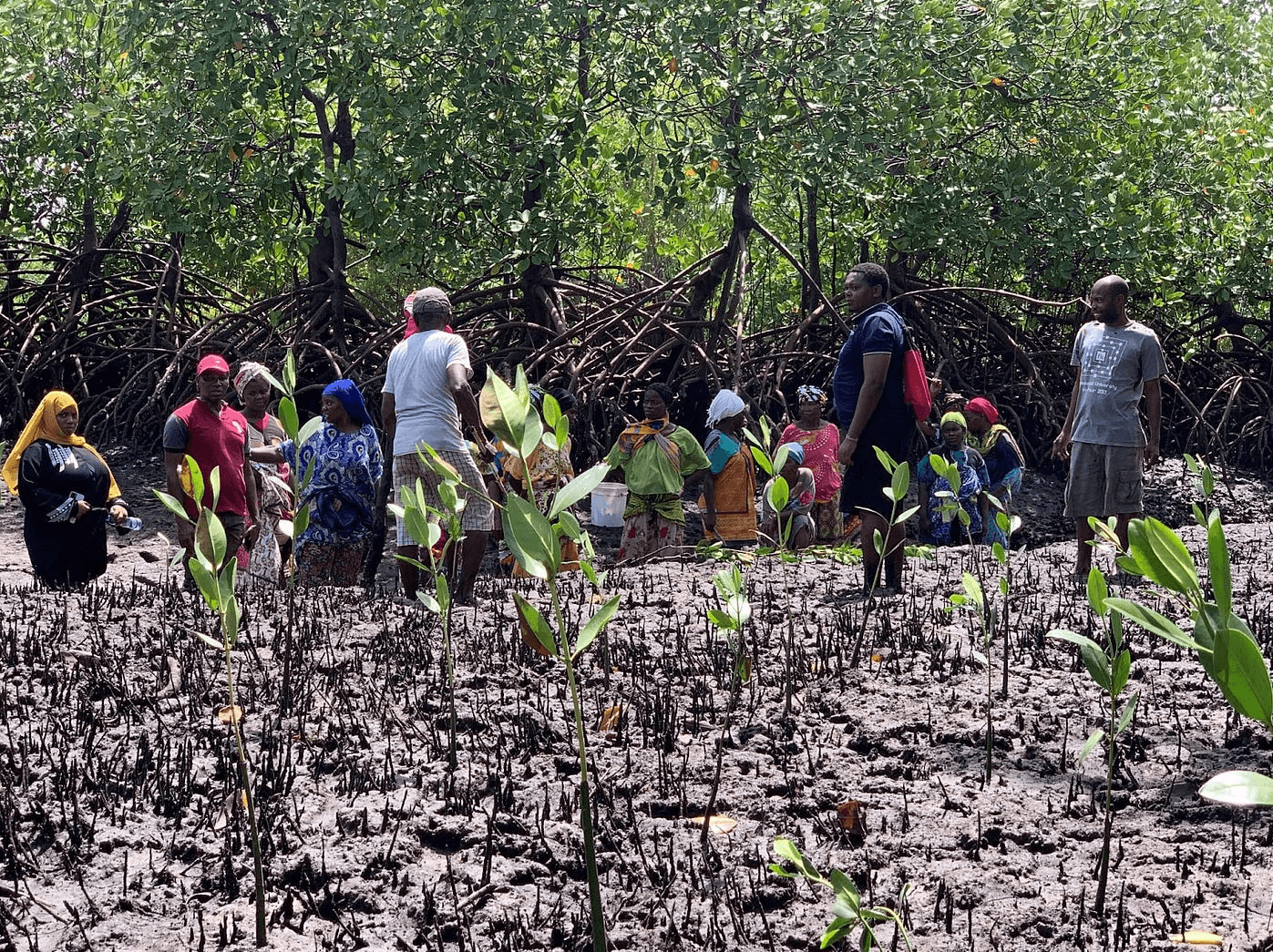

Mangroves are tropical coastal forests, known to be some of the most worthwhile ecosystem restoration sites. They have incredible co-benefits and their associated credits on Verra have a great track record in terms of demand from highly selective sustainability teams.

Nature-based Carbon Removal

These projects remove carbon from the atmosphere by sequestering it into the ecosystem.

Increased Biodiversity

Mangrove projects support extremely diverse ecosystems of flora and fauna found only in mangrove forests.

Community Benefits

These projects provide meaningful benefits to local communities economies, opportunities and safety. They even protect villages from hurricanes.

How it works

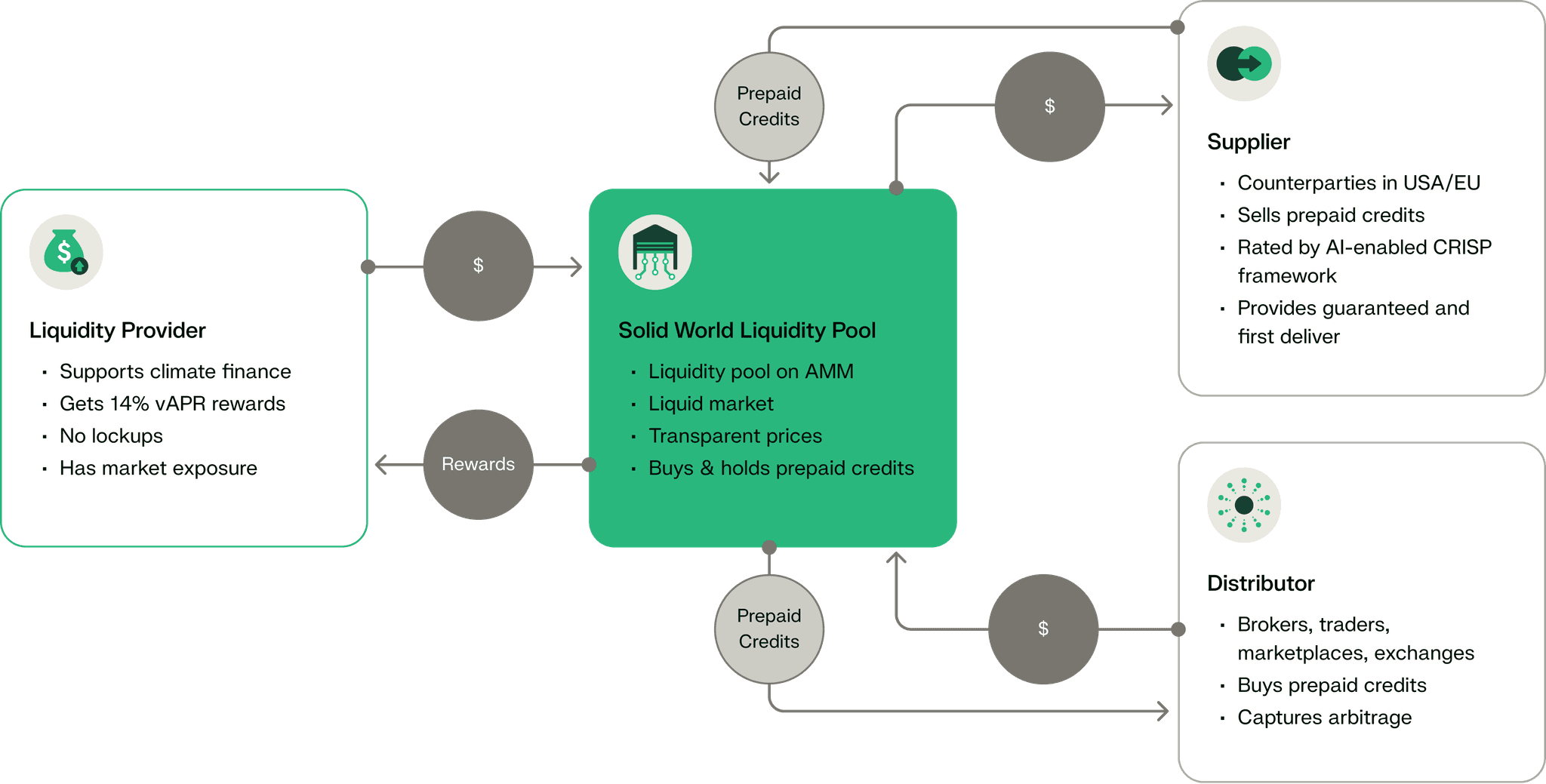

CRISP-M creates a market for prepaid Mangrove Restoration Carbon Credits

Suppliers

Suppliers deposit their forward carbon credits at a discount depending on how far they are from getting certified. They get to sell their CRISP-M tokens in the market for working capital.

Distributors

Buyers can use CRISP-M to redeem forward carbon credits, locking in supply from quality carbon projects that deliver real environmental, social and economic benefits to the world.

Liquidity Providers

Liquidity Providers collaboratively create the market that everyone can trade on, with each new liquidity provider making the market more efficient and robust, allowing for larger deals to be made.

Risks mitigated by legal structure and CRISP framework

Bankruptcy remote vehicle

All the underlying assets are protected in bankruptcy remote vehicle, and you have a claim to these assets, which mitigates the downside.

CRISP Framework

We mitigate the risk of non-delivery of the underlying asset via our Al-enabled CRISP framework that rigorously rates and qualifies every project. All suppliers provide guaranteed and top delivery. All contracts are public.

Market Exposure

As a liquidity provider, you will maintain exposure to the carbon credits as an asset class. The public predictions on the carbon markets are that they will 10-50x by the end of the decade.

Security Audits

All of Solid World’s production smart contracts which non-custodially handle transactions have been audited repeatedly by Dedaub, a well-respected blockchain security auditor. Our smart contracts and their audits are public.

To learn about the CRISP framework and how we are mitigating risks, please see our risks outline page.

Smart Contract Links

We are leveraging blockchain to create significant transparency in the climate finance lifecycle. Here are the smart contract addresses for all related contracts.

Uniswap Pool

0xc6832Ef0af793336aa44a936E54b992BfF47e7CdSolid World Manager

0xe967aEBdbf137C2ddD4aaF076E87177c4EBEB851Solid World Staking

0xaD7Ce5Cf8E594e1EFC6922Ab2c9F81d7a0E14337